In recent years, digital technologies such as artificial intelligence, robotic, IOT (internet of things), augmented reality, virtual reality and blockchain have started to be a part of our daily life thanks to:

- Substantial increase in the processing power of computers

- Advances in big data and cloud technologies

- Proliferation of wireless networks

Digital transformation has become the number-one agenda item of executives. They have started to spend millions of dollars for digital transformation projects.

However, the ROI related to these digitalization efforts is not as expected at many companies. Only a small number of organizations succeed in leveraging the power of these digital technologies. Most of them either create digital products and services that the target audience has no interest in.

Copernicus said, “What appear to us as motions of the sun arise not from its motion but from the motion of the earth and our sphere, with which we revolve about the sun like any other planet.” After the acceptance of Copernicus’ theory, people perceived the sun as the center of the planets in the solar system. This was a paradigm shift in the mindset of human beings who had envisioned the earth as the center of the universe throughout history. This new way of thinking hastened developments in science.

Similarly, a similar paradigm shift has to occur in the mindset of people responsible for digital transformation. The shallow technology-centric mindset has to be replaced with a more human-centric one.

Organizations should realize that innovation cannot be achieved at the technical level. Innovation is a matter of formulating solutions that best meet user needs. Therefore, digital technologies should be regarded as tools rather than final objectives. Steve Jobs commented on this situation as follows: “You have got to start with the customer experience and work back towards the technology—not the other way around.” He also said, “True innovation comes from recognizing an unmet need and designing a creative way to fill it.”

Being a human centered methodology design thinking is very helpful to realize this approach.

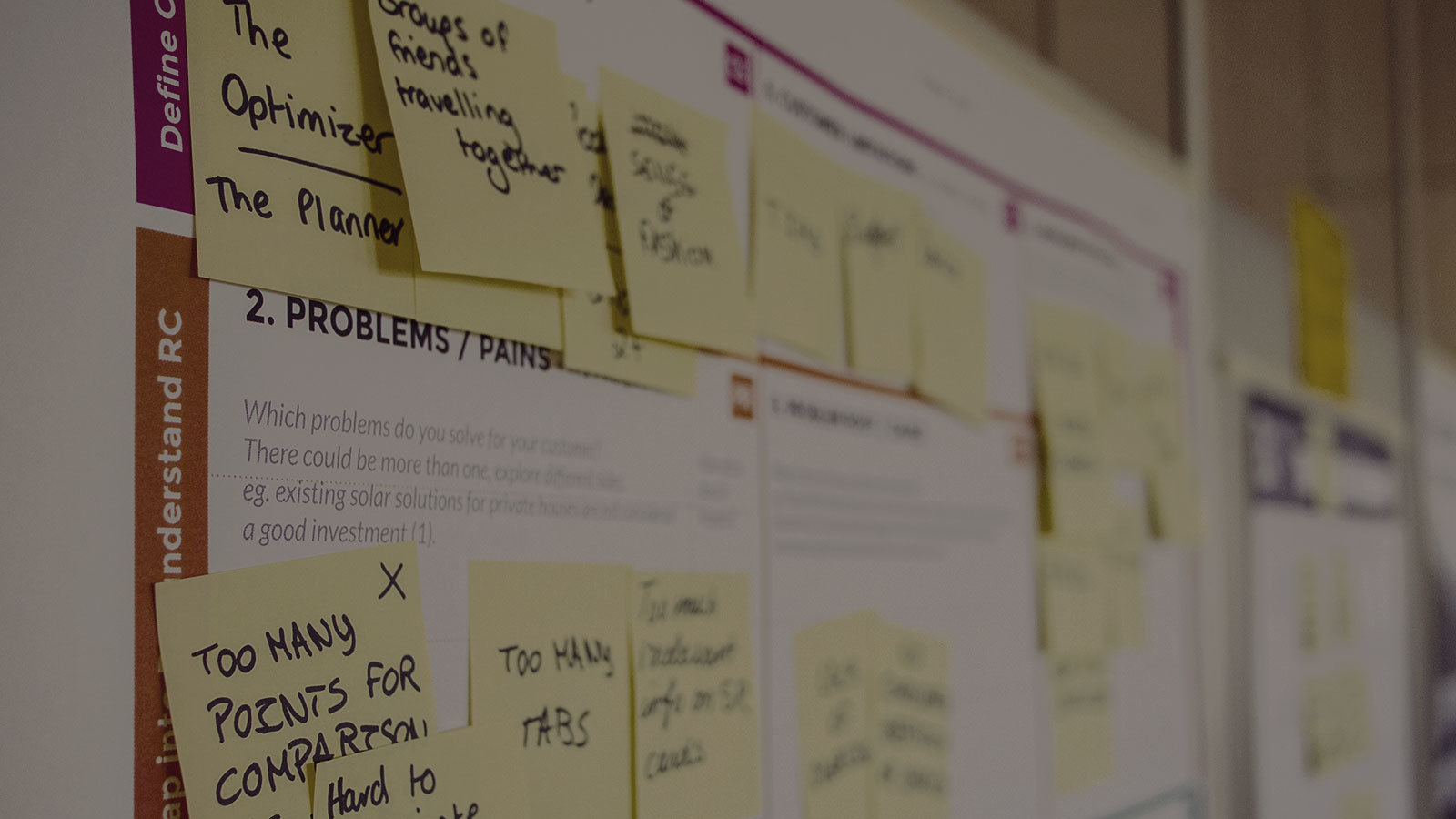

At design thinking workshops that are organized as a part of digital transformation projects, the challenge statement should be defined in a customer centric format like “how might we create attract, engage and retain customers by digitalization” rather than a technology centric approach like “how might we apply most recent digital technologies in our company.” At the workshops, participants should not think about digitalization until customer needs are identified. After interpretation of customer insights facilitators should ask participants to ideate about creative digital solutions based on customer needs and insights. Before ideation session it will be helpful to give brief information about digital technologies in case participants have no or limited knowledge. Then the ideas should be prioritized as “wows”: high value digitalization ideas that can be implemented without too much resources, “hows”: digitalization ideas for future and “nows”: quick wins. Upon prioritization, the selected ideas should be prototyped for customer feedback. By applying this customer centric and insight driven approach, digital solution ideas that creates an aura on the target audience can be generated.

Insurance is one of the industries that experience a fierce price competition and has a high risk of commoditization. Ever changing customer patterns in other industries are also creating extra pressure. For instance, proliferation of autonomous cars and ride sharing brings extra questions on who to insure, how to insure and at what price to insure.

To overcome this challenge, visionary insurance companies try to differentiate themselves by designing better customer experiences. The most successful of them are customer centric ones that can capture customer insights and turn them into great experiences by using digital technologies.

For instance, the following digital solutions became highly effective at insurance companies since they were designed based on customer insights:

- An insurance company designed a peer to peer insurance solution where people can join with their friends and families and apply together for insurance with discounted rates. Every new peer connection brings extra discounts. They get refunds if they don’t have claims during the year. This P2P digital insurance solution was created based on the insight that “people give great importance to their families’ and colleagues’ advices before they procure insurance policies.” Additionally, “they always have the fear of being overpriced by the insurance company even if they are a loyal customer.”

- An insurance company focusing on young customers created a mobile insurance application that speeds up the insurance application and claim process to seconds. You can apply and get approval only by talking to a chatbot and make a claim only by a video chat thanks to the artificial intelligence technology at the back-end. The solution was created on the insight that “young customers were finding the application and claim process as bureaucratic, complex and time consuming.” The company became the number one preference of young customers in a very short span of time.

- A home insurance company created a product that was based on the insight that: “customers expect to be protected more than to be insured.” The insurance company provides you a smart home system in addition to the insurance policy. IOT based sensors at your home send notifications to your mobile in case of a fire, theft or flood situation. It makes you claim payment in case there is a damage in your house. Another insurance company who captured a similar insight inserts a mobile device on your car that includes GPS and sensor technologies. It warns you in case you exceed speed limits and automatically call and sends you an ambulance if it thinks you had an accident based on the sensor data it gets. By this way it not only insures but also protects you.

- A health insurance company created a digital loyalty program that tracks your activities and rewards you for each activity that is good for your health such as buying fruits and sport memberships. It even counts your steps in a day via your smartphone. Based on these big data, it offers discounts in the next policy renewal. The digital solution was created on the insight that “people expect a more positive, assuring relationship from their insurance companies.”

- An insurance company moved with the insight to transform insurance from a necessary evil into a social good. While you are getting a policy through the mobile app, you select a nonprofit you care about. They give back a portion of the unclaimed money to the nonprofit you chose. By this way they bring a social barrier to fraud and also create a positive bond with their customers.

- An insurance company benefit from big data technologies to follow digital footprints and prevent fraud. For instance, in a car accident claim; if the system detects that the claim owners were friends on social media, it automatically sends the case for further investigation. Another insurance company use big data technologies to detect people with similar health problems and offer them group insurance policies.